Based on the Modified PME method.

from pypme import verbose_xpme

from datetime import date

pmeirr, assetirr, df = verbose_xpme(

dates=[date(2015, 1, 1), date(2015, 6, 12), date(2016, 2, 15)],

cashflows=[-10000, 7500],

prices=[100, 120, 100],

pme_prices=[100, 150, 100],

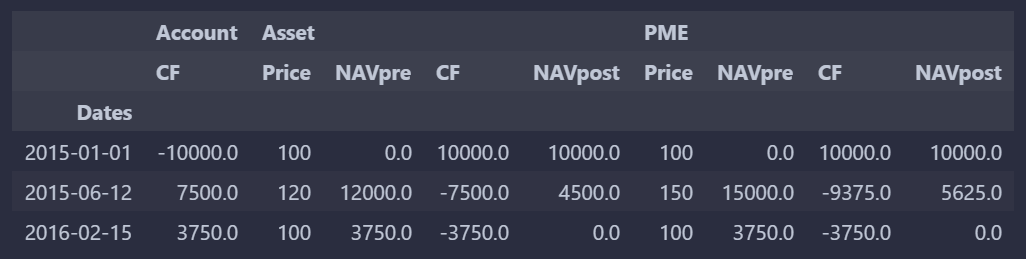

)Will return 0.5525698793027238 and 0.19495150355969598 for the IRRs and produce this

dataframe:

Notes:

- The

cashflowsare interpreted from a transaction account that is used to buy from an asset at priceprices. - The corresponding prices for the PME are

pme_prices. - The

cashflowsis extended with one element representing the remaining value, that's why all the other lists (dates,prices,pme_prices) need to be exactly 1 element longer thancashflows.

xpme: Calculate PME for unevenly spaced / scheduled cashflows and return the PME IRR only. In this case, the IRR is always annual.verbose_xpme: Calculate PME for unevenly spaced / scheduled cashflows and return vebose information.pme: Calculate PME for evenly spaced cashflows and return the PME IRR only. In this case, the IRR is for the underlying period.verbose_pme: Calculate PME for evenly spaced cashflows and return vebose information.tessa_xpmeandtessa_verbose_xpme: Use live price information via the tessa library. See below.

Use tessa_xpme and tessa_verbose_xpme to get live prices via the tessa

library and use those prices as the PME. Like so:

from datetime import datetime, timezone

from pypme import tessa_xpme

common_args = {

"dates": [

datetime(2012, 1, 1, tzinfo=timezone.utc),

datetime(2013, 1, 1, tzinfo=timezone.utc)

],

"cashflows": [-100],

"prices": [1, 1],

}

print(tessa_xpme(pme_ticker="LIT", **common_args)) # source will default to "yahoo"

print(tessa_xpme(pme_ticker="bitcoin", pme_source="coingecko", **common_args))

print(tessa_xpme(pme_ticker="SREN.SW", pme_source="yahoo", **common_args))Note that the dates need to be timezone-aware for these functions.

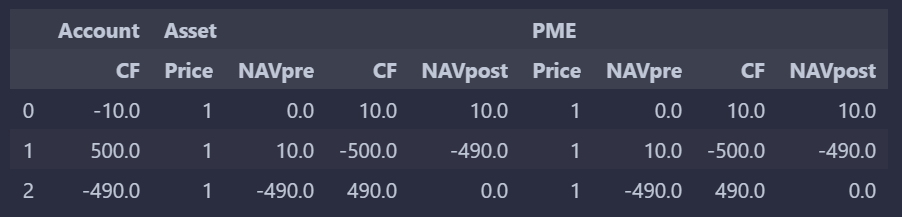

Note that the package will only perform essential sanity checks and otherwise just works with what it gets, also with nonsensical data. E.g.:

from pypme import verbose_pme

pmeirr, assetirr, df = verbose_pme(

cashflows=[-10, 500], prices=[1, 1, 1], pme_prices=[1, 1, 1]

)Results in this df and IRRs of 0: