Name

BBMA突破策略BBMA-Breakthrough-Strategy

Author

ChaoZhang

Strategy Description

[trans]

BBMA突破策略是一种利用布林带和移动平均线的组合来产生交易信号的策略。该策略同时使用布林带上轨和下轨以及快速移动平均线和普通移动平均线之间的交叉作为入场信号。当价格突破布林带上轨线且快速移动平均线上穿普通移动平均线时做多,当价格跌破布林带下轨线且快速移动平均线下穿普通移动平均线时做空。

该策略主要基于布林带理论和移动平均线理论。布林带被广泛应用于量化交易中,它由中轨、上轨和下轨线组成。中轨线是一定周期内的收盘价的简单移动平均线,上下轨线分别是中轨线上下一个标准差univ的距离。如果价格接近上轨表示市场可能超买,如果价格接近下轨表示市场可能超卖。

移动平均线也是常用的技术指标,主要用来判断潮向,判断主力资金的流入流出。快速移动平均线能更快捕捉价格变化趋势,普通移动平均线更加稳定。当快速移动平均线上穿普通移动平均线时为黄金交叉,代表市场可能步入上升行情。

该策略综合考虑了布林带理论和移动平均线理论,通过价格突破布林带上下轨并且快慢均线发生特定交叉的组合信号判断市场买卖点,作为入场信号指引交易方向。

-

使用布林带理论判断市场买卖点,有利于抓住价格反转机会。

-

综合考量快速移动平均线和普通移动平均线的交叉信号,避免假突破。

-

建立止损和止盈点有利于严格控制风险。

-

回测数据充足,收益率较高,胜率较好。

-

布林带参数设置不当可能导致交易信号错误。

-

快慢均线交叉信号发出滞后可能带来不必要亏损。

-

止损点设置过于宽松,无法有效控制单笔损失。

-

市场可能出现极端行情导致止损点被突破。

-

优化布林带参数,寻找最佳组合。

-

评估是否引入其他辅助指标过滤信号。

-

测试并优化移动止损策略进一步控制风险。

-

评估是否采用时间或价格突破方式止损。

BBMA突破策略整合运用布林带和移动平均线理论判断交易信号。该策略稳定性较好,收益较高,可控的风险水平。通过参数优化和风险控制手段可进一步提升策略胜率和收益回报率。该策略适合中长线持仓交易者使用。 ||

The BBMA breakthrough strategy is a strategy that uses a combination of Bollinger Bands and moving averages to generate trading signals. The strategy uses both the upper and lower rails of the Bollinger Bands and the crossovers between the fast moving average and the ordinary moving average as entry signals. Go long when the price breaks through the upper rail of the Bollinger Bands and the fast moving average crosses above the ordinary moving average, and go short when the price breaks through the lower rail of the Bollinger Bands and the fast moving average crosses below the ordinary moving average.

This strategy is mainly based on the theory of Bollinger Bands and the theory of moving averages. Bollinger Bands are widely used in quantitative trading, consisting of middle rail, upper rail and lower rail. The middle rail is the simple moving average of closing prices over a certain period, and the upper and lower rails are respectively one standard deviation away from the middle rail. If the price is close to the upper rail, it indicates that the market may be overbought. If the price is close to the lower rail, it indicates that the market may be oversold.

The moving average is also a commonly used technical indicator, mainly used to judge the trend and judge the inflow and outflow of main funds. The fast moving average can capture price changes faster, and the ordinary moving average is more stable. When the fast moving average crosses above the ordinary moving average, it is called the golden cross, indicating that the market may enter an upward trend.

This strategy takes into account both Bollinger Bands theory and moving averages theory. It determines market entry and exit points through the combination signal of price breaking through the upper and lower rails of Bollinger Bands and special crossovers between fast and slow moving averages, and uses it as the entry signal to guide trading direction.

-

Using Bollinger Bands theory to determine market entry and exit points is conducive to capturing price reversal opportunities.

-

Comprehensively considering the crossover signals of fast and ordinary moving averages avoids false breakouts.

-

Establishing stop loss and take profit points helps to strictly control risks.

-

Sufficient backtest data, high rate of return, good win rate.

-

Improper parameter settings of Bollinger Bands may cause wrong trading signals.

-

The lag of moving average cross signals may lead to unnecessary losses.

-

The stop loss point is set too loose to effectively control single losses.

-

Extreme market conditions may break through stop loss points.

-

Optimize Bollinger Bands parameters to find the best combination.

-

Evaluate whether to introduce other auxiliary indicators to filter signals.

-

Test and optimize moving stop loss strategies to further control risks.

-

Evaluate whether to use time or price breakthrough methods for stop loss.

The BBMA breakthrough strategy integrates the use of Bollinger Bands and moving average theory to judge trading signals. This strategy has good stability, high returns, and controllable risk levels. Parameters optimization and risk control measures can further improve the win rate and return on investment of the strategy. The strategy is suitable for medium and long term position holders. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | BBMA Length |

| v_input_2 | 2 | Deviation |

| v_input_3 | 50 | EMA Period |

| v_input_4 | 10 | Fast EMA Period |

| v_input_float_1 | true | Stop Loss Percentage |

| v_input_float_2 | 2 | Take Profit Percentage |

Source (PineScript)

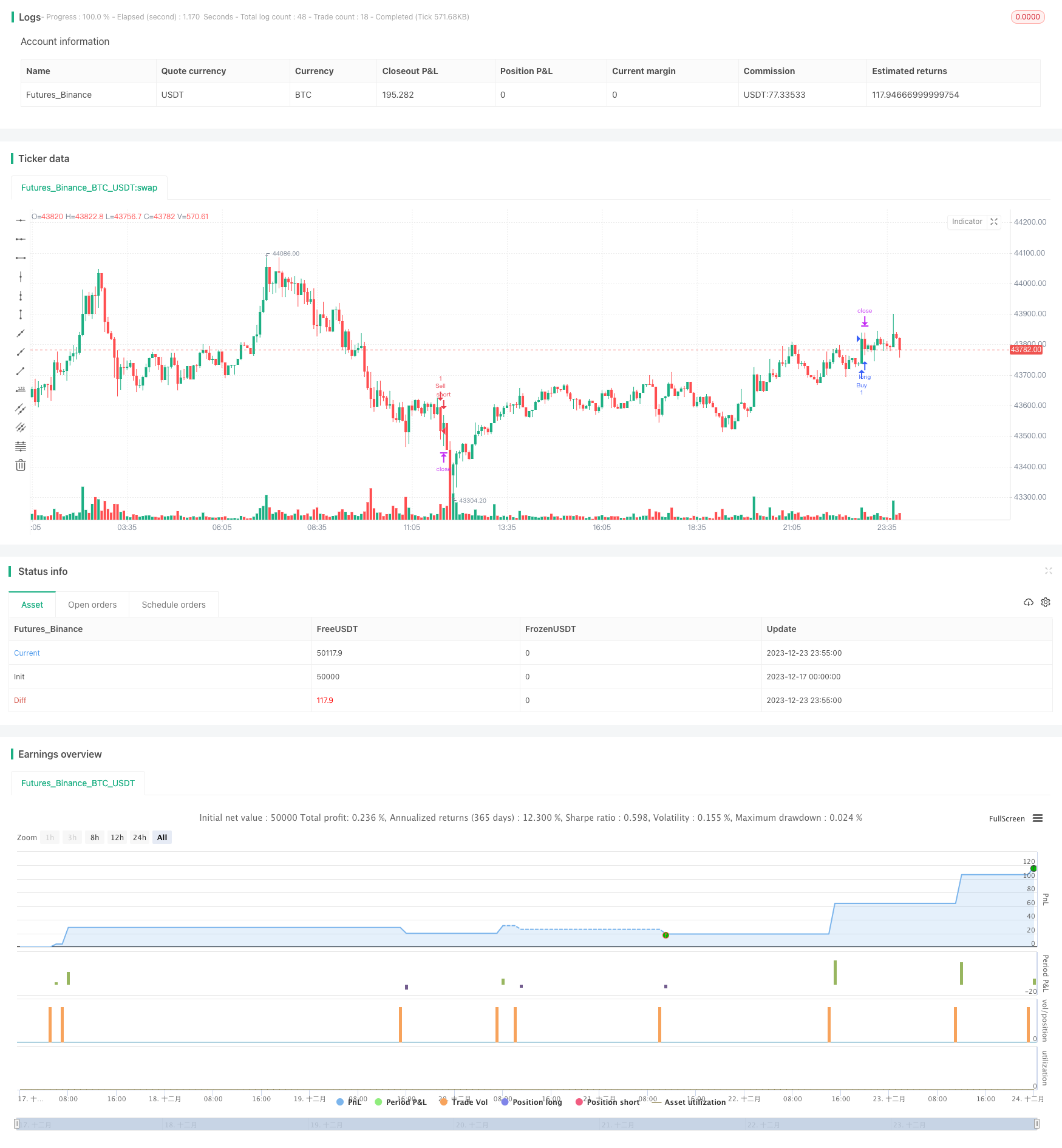

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BBMA Strategy", shorttitle="BBMA", overlay=true)

// Input parameters

length = input(20, title="BBMA Length")

deviation = input(2, title="Deviation")

ema_period = input(50, title="EMA Period")

fast_ema_period = input(10, title="Fast EMA Period")

stop_loss_percentage = input.float(1, title="Stop Loss Percentage") / 100

take_profit_percentage = input.float(2, title="Take Profit Percentage") / 100

// Calculate Bollinger Bands and MTF MA

basis = ta.sma(close, length)

dev = deviation * ta.stdev(close, length)

upper_bb = basis + dev

lower_bb = basis - dev

ema = ta.ema(close, ema_period)

fast_ema = ta.ema(close, fast_ema_period)

// Entry conditions

long_condition = ta.crossover(close, upper_bb) and ta.crossover(close, fast_ema) and close > ema

short_condition = ta.crossunder(close, lower_bb) and ta.crossunder(close, fast_ema) and close < ema

// Signals for entry and exit with stop loss and take profit

if (long_condition)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", stop=close * (1 + stop_loss_percentage), limit=close * (1 + take_profit_percentage))

if (short_condition)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", stop=close * (1 - stop_loss_percentage), limit=close * (1 - take_profit_percentage))

Detail

https://www.fmz.com/strategy/436483

Last Modified

2023-12-25 11:33:50